My Thoughts on Economics & Tax

Table of Contents 📖

| Topic ID | Topic Title | Timestamp |

|---|

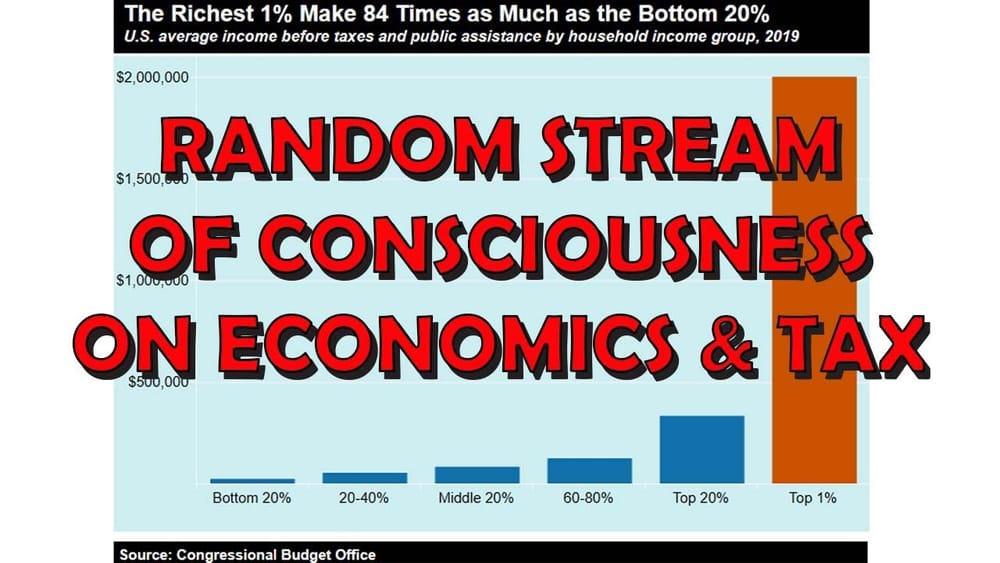

"At some point, there's got to be a moral problem with that inequality."

Hello Team!

Jonathan addresses some critical comments on his views about billionaires and tax cuts. He wants to have a look at the other side of the argument and open minds.

Return to top⤴️

Reductio ad absurdum

Jonathan uses a philosophical argument called reductio ad absurdum to question whether it is morally acceptable for the richest person to have an insane amount of wealth while many around them live in abject poverty. He argues there must be a "tipping point" where the level of inequality becomes unacceptable, even if the exact line is fuzzy. He gives the example of Putin's extravagant wealth compared to the poverty of many Russians.

Return to top⤴️

Brownback tax cuts in Kansas

The Brownback tax cuts in Kansas, which mainly benefited the rich, were a "complete disaster" according to Jonathan. They did not bring in extra tax revenue as promised and had to be repealed. Kansas provided a perfect test case since surrounding states did not implement similar cuts. Nearly all analysis concluded the cuts failed to deliver the promised economic boost.

Return to top⤴️

Trump tax cuts

Jonathan argues, contrary to a commenter's claim, that the Trump tax cuts were also problematic and did not significantly increase tax revenues. The post-pandemic economic rebound, not the tax cuts, drove recent revenue increases. Jonathan cites US government data to back up his view that the Trump cuts were "not cool".

Return to top⤴️

Defending US billionaires

In response to a commenter defending US billionaires, Jonathan questions how much inequality is acceptable. He argues what matters is maximizing overall societal happiness and wellbeing. Countries with the highest happiness rankings, like Finland and Denmark, tend to have higher taxes that fund strong social safety nets. This provides citizens existential security and peace of mind. Jonathan cites examples like Bill Gates admitting he has been disproportionately rewarded compared to others who work just as hard. He argues at some point extreme wealth inequality, even if billionaires do productive things with their money, becomes obscene and unnecessary for society.

Return to top⤴️

Meritocracy vs inherited wealth

Jonathan critiques former UK Prime Minister Theresa May for claiming to want a meritocracy while also proposing raising the inheritance tax threshold. He argues inheritance is the opposite of meritocracy - it gives some a random, unearned advantage due to accident of birth. A true meritocracy requires inheritance taxes to help level the playing field and equalize opportunity (but not necessarily outcome).

Return to top⤴️

Wrap up

In summary, Jonathan respects capitalist economics as the "least worst" system. But he favours a mixed economy with sensible regulation and a strong welfare state, like the Nordic model. His key metric is maximizing overall societal happiness and wellbeing. He recommends Ha-Joon Chang's book "23 Things They Don't Tell You About Capitalism" as a good primer on these economic issues.

Return to top⤴️